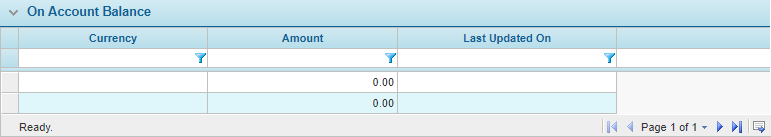

On Account Balance

The On Account Balance page lists the stored funds for the current Bill to Party. An on account balance can come from pre-payments, payments that have not been matched to invoices yet, or payments that exceeded the invoice totals. If funds exist in more than one currency, a separate entry will exist for each currency.

Click a link in the Currency column to view the breakdown of the current balance. The On Account Balance Details modal opens.

Some columns have been hidden.

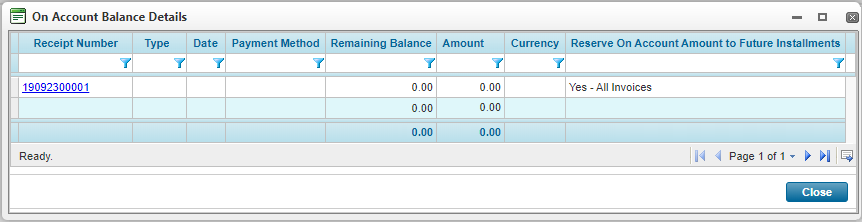

The On Account Balance Details modal lists each receipt for which all or part of the payment went on account.

Click a link in the Receipt Number column to view the Receipt details window.

Click Close in the On Account Balance Details modal to close the modal and return to the On Account Balance page.

Click Close on the On Account Balance page to return to the Bill To Parties list.

On Account Balance Amounts - Refunds and Future Installments

When an overpayment on a posted batch is processed, the overpaid amount is added to the On Account Balance section for the Bill to Party.

Users working within the Bill to Party can specify whether an On Account Balance amount should be eligible for a refund or can be reserved for future installments.

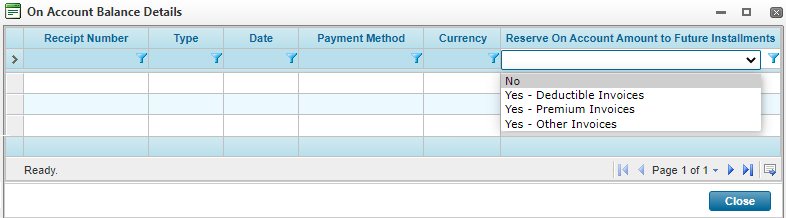

Some columns have been hidden.

- Navigate to the On Account Balance Details modal of the receipt you are working in.

- Select what the On Account Balance amount is applicable to by double-clicking inside the grid cell in the Reserve On Account Amount to Future Installments column.

-

Select an option:

- Click outside of the cell to apply the changes.

- Click Close to exit the On Account Balance Details modal.

Once the On Account Balance is made eligible for refunds or is reserved for future installments, this information is displayed on the Receipt Information panel.

Note: When an overpayment is made and the On Account Balance amount is moved, the OAB should always be linked to a Policy Term in order to initiate the Invoice Future Charges process, however, the system only moves the OAB when the provided policy has a unique policy term. If the OAB should be allocated to the policy term, then a reference code to identify the policy terms must be provided.