Cash Receipt Reversals

When a payment used to pay outstanding invoice amounts is reversed, the invoices that hold at least one future charge should be voided when there is a Cash Receipt Reversal, so that new invoices are generated as per the original Payment Plan of the Policy Term.

If a user overpays in full a policy with a multi-payment plan, the system groups all future charges into a single invoice and sets the outstanding amount to zero (Fully paid). If subsequently the payment is reversed (e.g. check bounced) the outstanding amount on the invoice is updated from zero back to the total outstanding amount found by summing all charges it contains. The charges grouped in the invoice remain in Invoiced status.

When reversing the payment, invoices containing all charges with a due date in the past will have all payment(s) reversed, while invoices containing any charges with a due date in the future will be voided. If there are any invoices in the policy term linked to an active cash receipt, the system will move the allocation amount of the active cash receipt to the On Account Balance and link it to the policy term. Upon reversing the cash receipt, the respective General Ledger Accounts will be balanced.

Reversing a Cash Receipt

The following steps are to be repeated for each policy term that the cash receipt being reversed is linked to.

-

From the main menu, go to Billing, then Transactions, and click Receipt Corrections.

-

Select the appropriate Billing Entity.

-

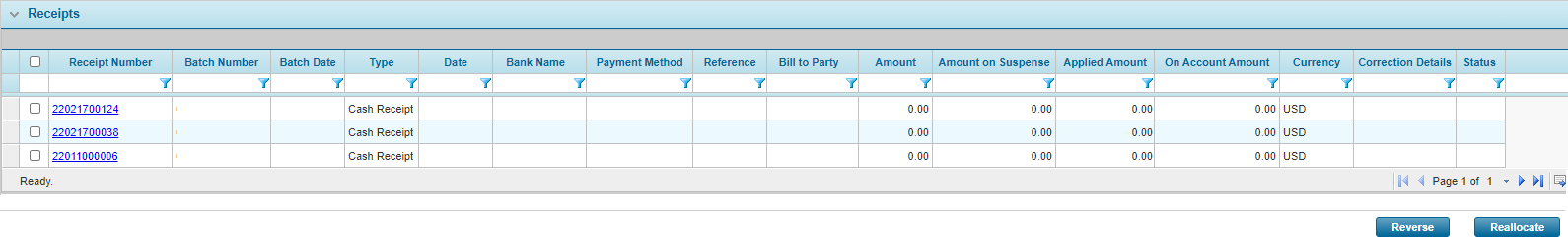

Enter the Reporting Period or Bill to Party to search for the receipts to be reversed. The Receipts list will display.

-

From the Receipts list, select the receipt to be reversed by checking the box next to the Receipt Number column.

The system ensures that the receipt selected has a Charge Date that is greater than the cash receipt reversal date, and then the invoice linked to the cash receipt is voided. The system will verify if any Allocation receipts are also linked to the selected invoice. If an allocation amount is available;

-

The user must reverse all allocation amounts linked to the selected invoice.

-

To do so, from the Receipts list, select the Account Balance Receipt(s) by checking the box next to the Receipt Number.

-

Click the Reverse button. The Receipt Reversal window will display.

-

Enter at a minimum the Reversal Date and select the Correction Reason. If needed, enter another reason other than the one selected and a brief description.

-

Click Post to reverse the allocation amount, or click Close to close the Receipt Reversal window without reversing the amount.

-

-

Upon reversing the Allocation amounts, the General Ledger entries linked to the Allocation receipt are also reversed.

-

-

The user must now reverse the Cash Receipt.

-

To do so, from the Receipts list, select the Cash Receipt(s) by checking the box next to the Receipt Number.

-

Click the Reverse button. The Receipt Reversal window will display.

-

Enter at a minimum the Reversal Date and select the Correction Reason. If needed, enter another reason other than the one selected and a brief description.

-

Click Post to reverse the Cash Receipt, or click Close to close the Receipt Reversal window without reversing the amount.

-

-

The system will verify if any invoice in the Policy Term is associated to other active Cash Receipts.

-

If yes, then the system moves the allocation amount of the active Cash Receipt to the On Account Balance linked to the policy term and reverses GL entries linked to the reversed allocation amount.

-

When the payment is made through the OAB, upon reversing the allocation amount, the system will add the allocation amount to the existing receipt and reverse the GL Entries linked to that receipt.

-

When the payment is made directly from the Cash Receipt, upon reversing the allocation amount the system will create a new system-generated cash receipt with the Receipt Type of Cash Receipt Reversal and link the allocation amount and respective GL Entries to the new receipt.

-

-

For each invoice in the policy term, verify if any of the charges has a Charge Date greater than the Cash Receipt Reversal Date.

-

If yes, then any charge that has a charge date that is greater than the cash receipt reversal date, continue to next step for the respective invoice.

-

If no, then for all charge dates that are less than or equal to the Cash Receipt Reversal Date, the system will reset the invoice outstanding amount to Total Charge Amount.

-

-

The system will then void the invoice by:

-

Setting the invoice status to Void.

-

Updating the invoice outstanding amount to 0.

-

Reversing the General Ledger entries against the invoice.

-

The GL entries that are reversed upon voiding the invoice are as follows:

| GL Account | Entry Type | Entry Date |

Amount

|

| Commission Payable | Debit | Cash Receipt Reversal Date | Invoice Amount |

| Invoiced Commission | Credit | Cash Receipt Reversal Date | Invoice Amount |

| Tax Payable | Debit | Cash Receipt Reversal Date | Invoice Amount |

| Invoiced Tax | Credit | Cash Receipt Reversal Date | Invoice Amount |

The following GL entries are reversed upon moving the allocation amount linked to the active cash receipt to the OAB.

| GL Account | Entry Type | Entry Date |

Amount

|

| Advanced Premium | Credit | Cash Receipt Reversal Date | Allocation Amount |

| Premium Acct Receivables | Debit | Cash Receipt Reversal Date | Allocation Amount |

The Billing reports will be updated to display the void Invoice details. Note that the Void Invoice details will not be available in the Payables Report. Note that all invoices in the policy term contain charges from the same policy term.