Insurers

In This Topic...

The Insurers page is used to manage insurance companies that serve as underwriters for the insurance product.

There are two methods for assigning insurers, controlled by the Allow Multiple Insurers checkbox.

- Single Insurer configuration: The insurers are defined in this page, and triggers are used to assign an insurer during quote calculation. This method supports multiple quote options. See Single Insurer Configuration Through the Master Cover.

- Multiple Insurer configuration: The insurers are added to a table within the workflow, by means of calculated fields, integrations, or similar methods. This method supports multiple insurers attached to the same transaction, and will calculate individual insurance costs per insurer. This method only supports products with a single quote option. See Multiple Insurer Configuration Through the Workflow.

Single Insurer Configuration Through the Master Cover

Whenever the system calculates the quote within a workflow, or when a user manually issues a quote, the system checks the insurer list in sequence and selects the first insurer whose trigger evaluates as true (if no trigger is assigned, it counts as true). Each time a quote is generated like this, the system evaluates the triggers again and possibly assigns a new insurer. Once a policy is bound, the selected insurer remains attached to that policy for the full term, including endorsements and reinstatements. The quote calculation itself has a specific sequence of events that may affect insurer selection, click here for details.

While only the first insurer whose trigger evaluates as true is attached to the submission, all insurers whose triggers evaluate as true (or who have no trigger) have access to the submission or policy. All users under those insurer companies have access, within the limits of their rights and administrative level. If the quote is recalculated again, all triggers are re-evaluated and all access is reset according to the new results of the triggers.

With the master cover selected, click the Insurers item in the Screens widget. The Master Cover - Insurers page opens. For instructions on finding and viewing a master cover, see the section on Viewing and Modifying a Master Cover.

| Product | Identifies the product associated with the master cover. |

| Status | Identifies the current status of the master cover. |

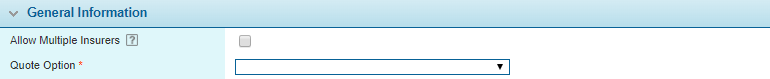

| Allow Multiple Insurers | Select whether transactions should support multiple insurers. To manage single insurers through the master cover, this option should be unchecked. To manage multiple insurers through the workflow, see Multiple Insurer Configuration Through the Workflow. |

| Quote Option | This field is available when Allow Multiple Insurers is unchecked. Select a Quote Option to view the insurers defined for that option. |

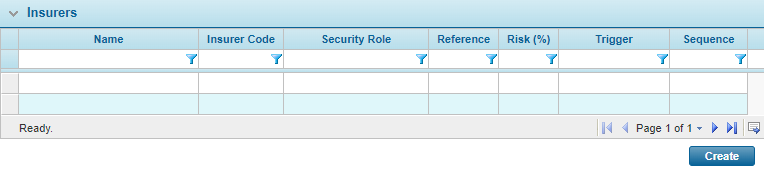

The Insurers panel is available when Allow Multiple Insurers is unchecked. This panel displays all insurers under the selected Quote Option.

- Select an action.

- Click a link in the Name column to view an existing insurer configuration.

- Click Create to add a new insurer configuration.

- On viewing or creating an insurer configuration, the Master Cover - Insurer page opens.

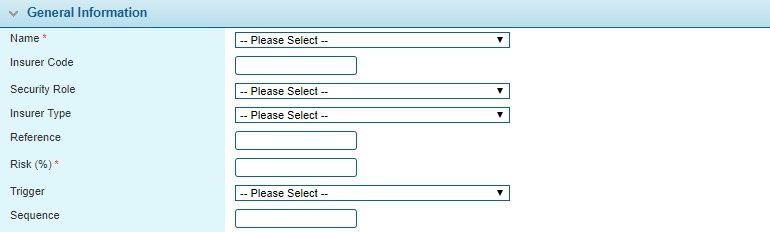

- The panels and fields are described below. Fields marked with a red asterisk * are required.

- Select an action.

- Click Add or Save to save the insurer and keep the window open.

- Click Add & Close or Save & Close to save the insurer and close the window.

- When viewing an existing insurer configuration, click Delete to remove the insurer. This leaves the insurer attached to existing submissions and policies, but unavailable for new submissions.

- Click Close to close the window without saving the insurer.

| Product | Identifies the product associated with the master cover. |

| Status | Identifies the current status of the master cover. |

Tip: If none of the triggers evaluate as true and there are no insurers without triggers, no insurer is attached to the submission. This results in a validation error when attempting to bind the policy. For this reason we recommend that the last insurer in the list (with the highest Sequence number) be a 'default' insurer with no trigger. This ensures that an insurer is attached to all submissions.

Back in the Master Cover - Insurers page, additional insurers can be added to the same Quote Option, or a different Quote Option can be selected.

Click Save to save the changes.

Note: If more than one insurer is available in the master cover, even across different Quote Options, insurer users will not see the premium in the Premium widget. If only one insurer is attached to the master cover, then users from that insurer company will be able to view the premium, if they have the necessary rights.

Multiple Insurer Configuration Through the Workflow

Multiple insurers are enabled in the master cover, but the list of insurers managed entirely within the workflow. When multiple insurers are assigned to a transaction, insurance costs are divided according to the defined risk percentages, and all insurers have access to the transaction.

With the master cover selected, click the Insurers item in the Screens widget. The Master Cover - Insurers page opens. For instructions on finding and viewing a master cover, see the section on Viewing and Modifying a Master Cover.

| Product | Identifies the product associated with the master cover. |

| Status | Identifies the current status of the master cover. |

| Allow Multiple Insurers | Select whether transactions should support multiple insurers. To manage multiple insurers through the workflow, this option should be checked. To manage single insurers through the master cover, see Single Insurer Configuration Through the Master Cover. |

| Checking this option hides all other options on this page. The rest of the configuration is managed through the workflow setup. | |

| Note that the multiple insurers option is only supported for products with a single Quote Option. |

Click Save to save the changes.

To support multiple insurers, the following configuration must be included in the workflow.

The system processes data from the Policy Insurers and Policy Insurer by Premium Type grids included in the OWPolicyCommon standard container. These grids should be included in the workflow. For details on the standard containers, see

Most of the fields in the two grids are read-only. The Insurer Code, Insurer Risk Percentage, and Lead Insurer fields for each insurer must be populated by functions, integrations, or similar methods prior to calculating a quote. When a quote is calculated, the system validates the insurer information and populates most of the remaining fields in the grids. Note that only a single insurer in the list can be marked as the Lead Insurer.

The Insurer Risk Percentage Override field in the Policy Insurer by Premium Type grid can be entered manually. In addition, if any values are already loaded into the Insurer Premium Type Code field, they will not be overwritten during quote calculation.

Once the insurers are validated and populated into the grids, the system provides each insurer company with the appropriate permissions to manage the policy term, transaction, and quote. If the Allow Insurers to Create / Edit Clients setting is checked, the insurers will also be given access to manage the client.

If an insurer is removed from the transaction, all associated permissions are revoked. Access to the client is not revoked.

Notes:

When initiating a Cancellation transaction, only the insurers and settings from the source transaction will be included in the refund calculation. Any insurers added, removed, or modified in other transactions will not be taken into account.

Example:

A New Business transaction is created with Insurer 1 and Insurer 2.

An Endorsement is created where Insurer 2 is removed, and Insurer 3 and Insurer 4 are added.

If the user initiates the cancellation from the New Business transaction, only Insurer 1 and Insurer 2 will be included in the transaction, and therefore the premium refund calculation.

If the user initiates the cancellation from the Endorsement transaction, only Insurer 1, Insurer 3, and Insurer 4 will be included in the transaction, and therefore the refund calculation.

When creating Out of Sequence (OOS) Endorsements and Adjustment transactions, the Replacement versions of the blocking transactions receive the insurers list from the out of sequence transaction instead of the original blocking transaction. Note that this only applies if the product is configured to update blocking transactions.

Example:

A New Business transaction is created with an effective date of 01-01-2017, and includes Insurer 1 and Insurer 2.

An Endorsement transaction is created with an effective date of 01-06-2017, where Insurer 2 is removed, and Insurer 3 and Insurer 4 are added.

An OOS Endorsement is created with an effective date of 01-04-2017. The insurers are copied from the New Business, resulting in Insurer 1 and Insurer 2.

The original Endorsement is voided, and a replacement Endorsement is created, incorporating changes from the OOS Endorsement. This replacement Endorsement receives Insurer 1 and Insurer 2 from the OOS Endorsement instead of Insurer 1, Insurer 3, and Insurer 4 from the original Endorsement.

To compensate for the changes to the blocking transactions, new endorsements can be created with the same effective periods as the original blocking transactions, containing the required insurers.